Vancouver/BC has become a leading Clean Energy Innovation Cluster in several Technologies/Industries, despite many challenges:

- smaller transportation/power industry and energy innovation ecosystem compared to many other regions, especially in the US, Japan, Korea, China, and Germany.

- relatively low needs for Clean Energy applications compared to other regions because of lower energy prices, lower pollution, and a smaller market

- higher cost of living for employees

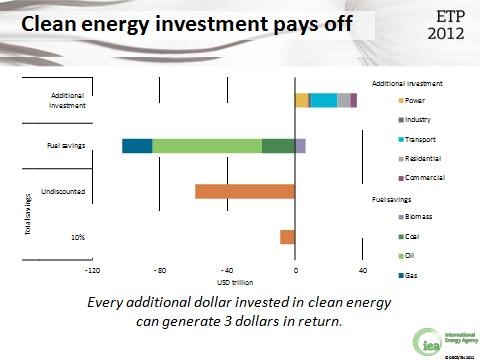

The medium and long term Policy and Business Case for Clean Energy is compelling, according to the IEA, and is summarized in their IEA Energy Technology Perspectives 2012. A summary excerpt chart is below:

Governments and Industry worldwide are collaborating and competing for business, projects, and products, and Clean Energy clusters are a big part of that.

Within the Vancouver/BC Cluster, examples of world leading Clean Energy technology companies in Vancouver include Westport, Ballard, and AFCC/Mercedes-Benz Fuel Cell. These companies are all acknowledged global world leaders in their sector, and all continue to attract significant Foreign Direct Investment from big OEM multinationals. There are many emerging or established small Clean Energy companies in Vancouver as well – dPoint Technologies, Endurance Wind Power, and Greenlight Innovation – to name a few. The BC Energy companies, such as BC Hydro or Fortis, are players in many Clean Energy projects. The BC Consulting Engineering companies all have Clean Energy services. The BC Government has laid out a near term strategy, including a recent focus on LNG (which is one of the cleaner fossil fuels, though still has a medium carbon intensity).

So, what are the four key ingredients for Vancouver/BC?

- World-leading technology/product prototypes and projects, which must be decisively better and more competitive than competing technologies, product prototypes, or projects from companies in other regions.

- For technologies/products, in the critical OEM/customer prototype evaluation phase, the prototypes must demonstrate a superior performance and high robustness to real-world usage profiles; as well as a pathway to cost effectiveness and high volume manufacturability. Though high-volume, low-cost manufacturing is not a typical fit for Vancouver, as it is more likely to be done in other regions and closer to the customer deployment regions; proving technology readiness can be easily done in Vancouver.

- Clean Energy Projects need to meet or beat the project intent – on time and on budget – and use the best Project Management, Engineering and Construction techniques, while navigating the complexities of stakeholders, the public, and politics.

Though self-evident the most critical ingredient is the competition. The core technology/product/project in Vancouver/BC must be extra competitive to prevent the host OEM/funding organization from doing the development in their backyard, or with their own internal resources.

- Target worldwide export markets, as the needs for Clean Energy technologies/products are higher in other regions (energy prices, availability, and pollution). The challenge of finding early applications in BC forces the Clean Energy industry to study the worldwide market and partner with strong companies from other regions – US, Germany, China, Japan, etc. to bring applications, help, and funding. By being export focused, it can also strengthen the development/project team in comparison to teams in other regions, since challenge breeds character.

- Build on Vancouver and BC’s strengths, especially in technology innovation, and where there is a critical mass of expertise or a strong competitive advantage; such as natural gas, hydro, environmental protection, energy management and power electronics, or PEM fuel cells. The Globe Foundation has summarized many of BC’s strengths in this 2010 report. Trying to catch up in areas where Vancouver/BC is not as strong is not practical, as noted in research by Pisano and Shih in this Harvard Business Review Article. For positive examples that Vancouver/BC should consider, in the USA, there are several cities that are clearly specializing in clusters, according to this article, such as Indianapolis in Life Sciences or San Antonio in Cybersecurity.

- Improved partnering between industry and government. Canada is well known for its supply of resources to global markets, and for its small-scale innovation. However, Canada does not have nearly as much success in turning innovative technology into global products, as it has just a handful of world leaders in other industries (for example: Bombardier or Blackberry). Collaboration is needed between industry and government in Clean Energy because of the high capital requirements, risks, regulations, and long timeframes. Canada and BC can especially build on other regions that have strongly supported their clusters with:

- Long term strategic policy support and National/Provincial strategies similar to Germany, Japan, Korea, and California (i.e. Roadmaps and Policy requirements through 2050)

- Procurement and demonstration of competitive BC/Canadian technologies/products to fill new needs where they make sense.

- Funding support through the gap between technology and commercial launch, such as from SDTC or BDC.

- More industry “pull” mechanisms on University/College Research and Student-Industry placement (i.e. through NSERC, NRC, Policy etc), similar to Germany and Japan

In closing, Clean Energy is a both a collaborative and a fiercely competitive sector; and with the right strategy, Vancouver/BC developers can be successful players.